Perpetual bond formula

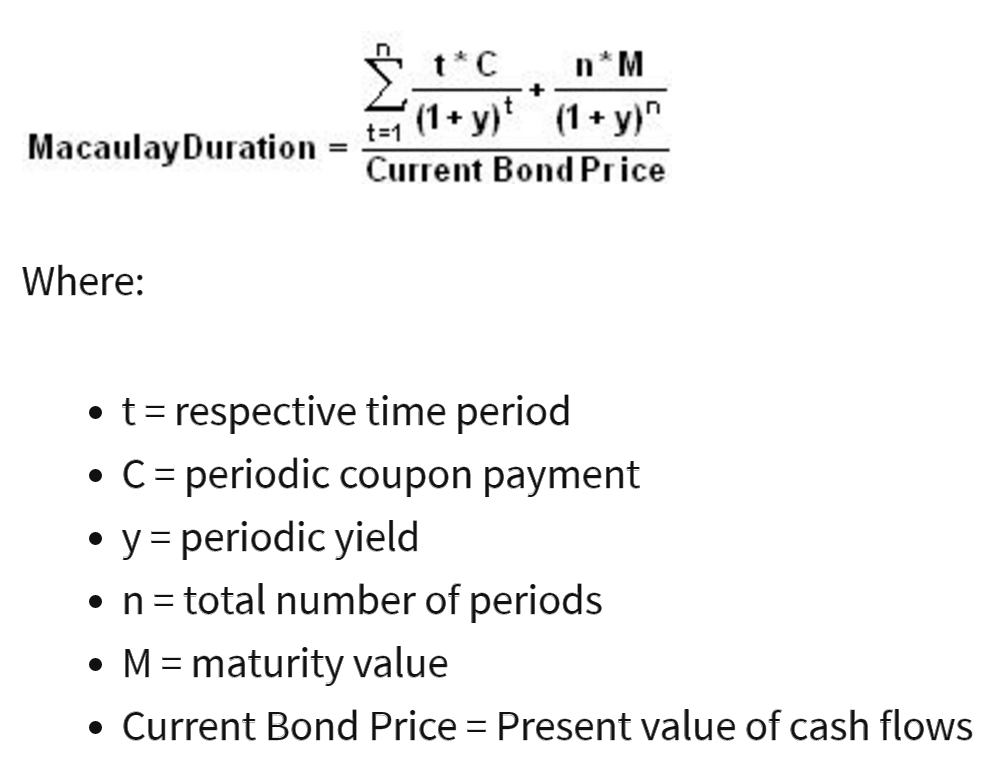

Perpetual bonds are valued using the formula. Now let assume that the par value of the bond is 100.

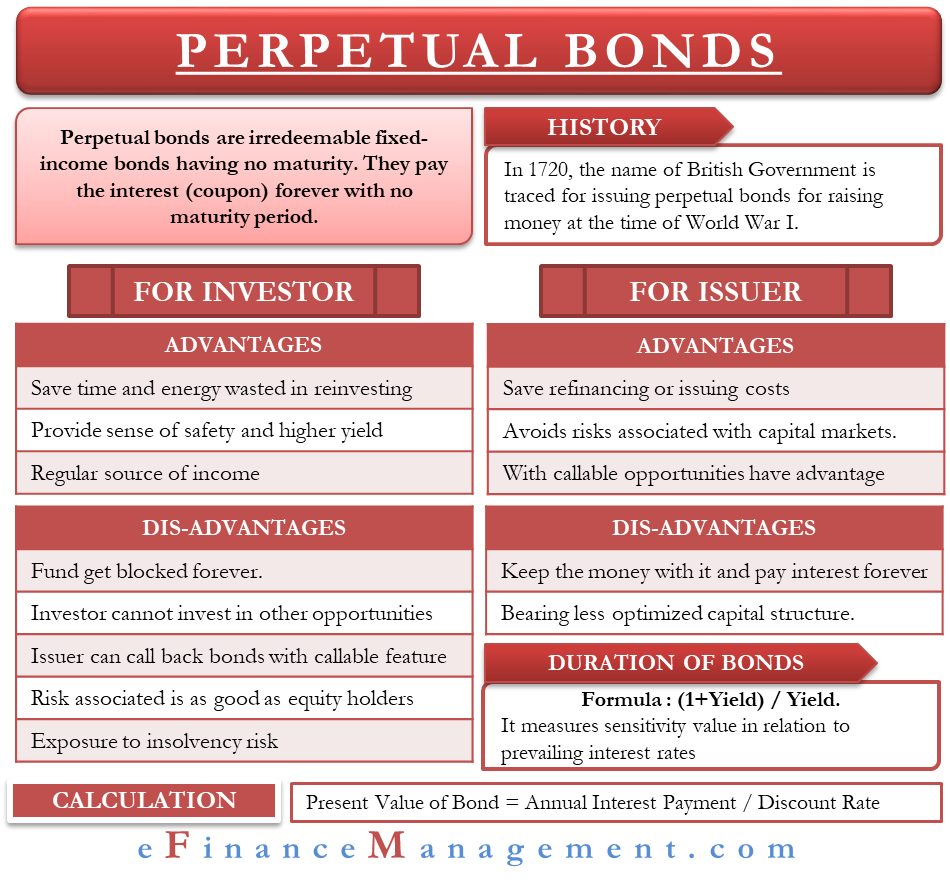

Perpetual Bonds Define Advantages Disadvantages Calculate Duration

References External links Perpetual debt in.

. Price of a perpetual bond Tags. Is an annual coupon interest on a bond. An example of the perpetuity yield formula would be.

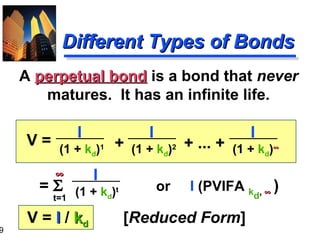

The value of the perpetual bond is the discounted sum of the infinite series. A perpetual bonds issuer often has the right to call or redeem it at any time after an agreed-upon period such as five years following the bonds issuance date. First of all we know that the coupon payment every year is 100 for.

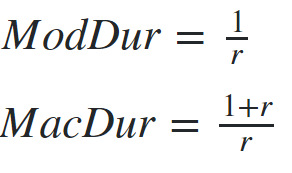

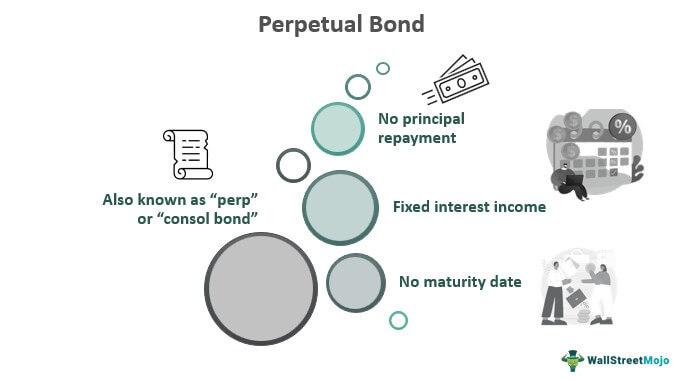

A perpetual bond is a fixed income security with no maturity date. Calculating Yield on Perpetual Bonds. Where I is the annual.

However the rate may change over time which will affect the value of the perpetual investment. This bond pays Smith 100 every year. There is a theoretical possibility of a Perpetual Bond having a Par Value aka Face.

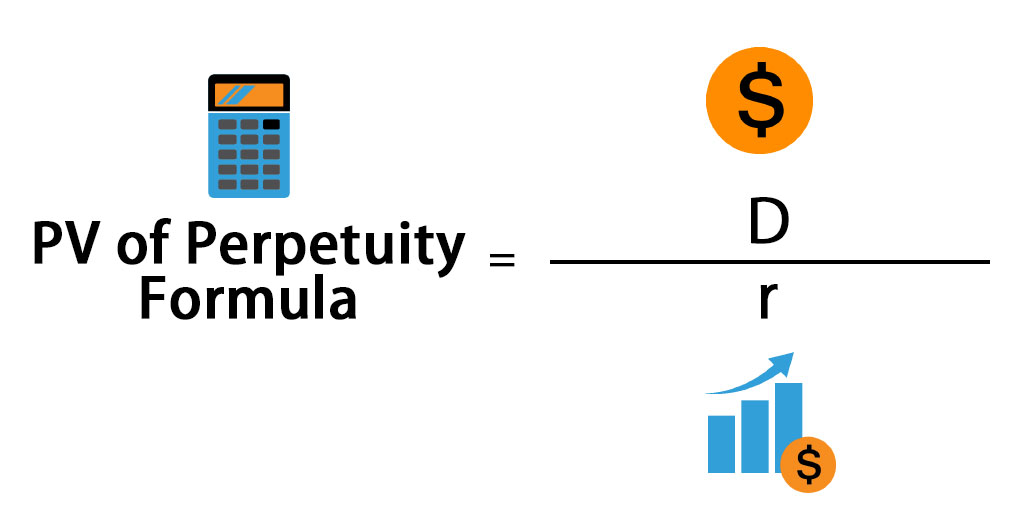

D is the coupon payment or regular payment on the bond and r is the discount rate. Assuming that the discount rate is 8 how much should Smith pay for this bond. The formula for calculation of value of such bonds is.

Formula for the calculation of the yield of a perpetual bond. Yield on a Perpetual Bond Formula. Assuming the discount rate is 4 the.

Formula P fracIr Legend I Nominal. If a perpetual bond pays 10000 per year and the discount rate is 4 the. Money is invested forever and interest from the bond is recurring throughout life.

Bonds pricing and analysis Description Formula for the calculation of the price of a perpetual bond. Current Yield Annual Dollar Interest Paid Market Price X. One major drawback to these types of bonds is that they are not redeemable.

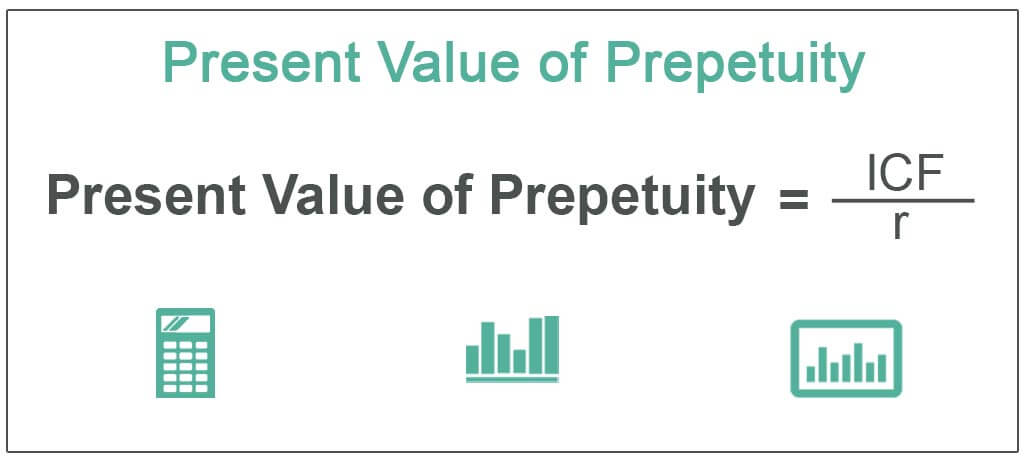

Perpetual bonds are irredeemable fixed-income bonds having no maturity. Formula for the Present Value of Perpetual Bond presently Dr And r is the bonds discount rate. Additional information related to this.

The discount rate depends upon. A Perpetual Bond is a fixed income security that pays a series of coupon payments interest forever. As a result some perpetual.

The issuers of perpetual bonds are not under any obligation to ever repay the bond purchasers principal. Formula r fracIP Legend I Nominal coupon rate P Bond clean price. Perpetual bonds are bonds with no maturity date.

I Required rate of return. Example of the Perpetuity Yield Formula. Below you will find descriptions and details for the 1 formula that is used to compute yields for perpetual bonds.

Investors can calculate how much return they will earn from a perpetual bond by using the following formula. Is an expected yield for maximum term available. The formula for calculating present value is D divided by r.

Investors can also calculate the yield on perpetual bonds with the same set of data.

Present Value Of Growing Perpetuity Formula With Calculator

Preferred Stocks Live Longer Than Bonds But Not Always Seeking Alpha

Bond Yield Formula Calculator Example With Excel Template

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Preferred Stocks Live Longer Than Bonds But Not Always Seeking Alpha

The Valuation Of Long Term Securities Prezentaciya Onlajn

Chapter 4 The Valuation Of Longterm Securities 4

11 2 Chapter 42 Why Shall We Know The Valuation Of Long Term Securities Make Investment Decisions Determine The Value Of The Firm Ppt Download

Pv Of Perpetuity Formula With Calculator

Perpetuity Formula Calculator With Excel Template

Present Value Of Perpetuity How To Calculate It Examples

Yield To Call Ytc Bond Formula And Calculator Excel Template

Impossible Finance The Perpetual Zero Coupon Bond By Martin C W Walker Medium

What Is A Perpetuity Definition Formula Video Lesson Transcript Study Com

Perpetual Bond Formula Duration Valuation What Is It

Explaining Consol Bonds Perpetual Bonds Corporate Finance Youtube

The Valuation Of Long Term Securities