Calculate daily wage

If you are entitled to overtime pay federal law stipulates it must be calculated weekly. In order to calculate the wage index standardization factor we simulate total payments using FY 2021 hospice utilization claims data with the FY 2022 wage index pre-floor pre-reclassified hospital wage index with the hospice floor without the 5-percent cap on wage index decreases and FY 2022 payment rates and compare it to our simulation.

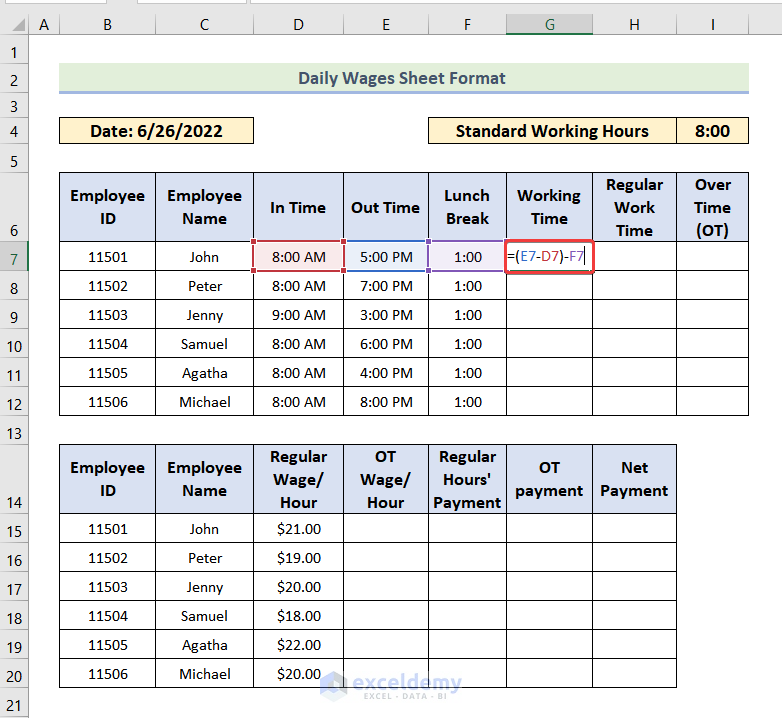

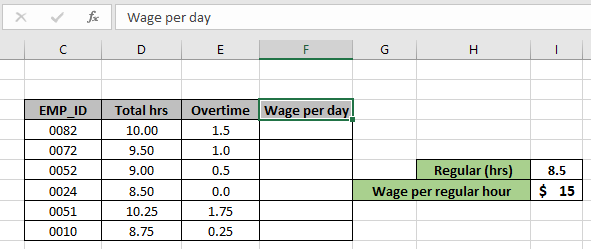

Excel Formula Basic Overtime Calculation Formula

2020 has caused many businesses to restructure their operations.

. Any wage or salary amount calculated here is the gross income. The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. 520 - 440 8000.

228 per week 988 per month 11850 per year. Where the pay is less than the appropriate minimum wage entitlement the employer will need to pay additional amounts until at least the appropriate minimum wage is paid for both working time and. 19 on annual earnings above the PAYE tax.

Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering Irish income tax Universal Social Charge and Pay-Related Social Insurance. The 40 hour work week is 5 8 hour days. 10 December 2020 Updated examples of when the calculator cannot be used.

Calculating overtime pay for hourly wages can be pretty simple. Daily wages are calculated using either the gross rate for paid public holidays paid leave salary in lieu and salary deductions or the basic rate for work on rest days or public holidays. Just make sure you note whether your state counts overtime on a daily or weekly basis before determining the amount you owe your employee.

You can enter your annual salary hourly wage or monthly salary and the daily wage calculator will instantly calculator what you are earning on a daily basis. Multiply the employees overtime pay rate by the number of overtime hours. Scottish starter tax rate.

Disposable earnings minus applicable minimum wage. Summary table of general. Vincent Jennings chief executive of the Convenience.

SR 125 Daily wages Daily working hours Hourly overtime wages. You will see the hourly wage weekly wage monthly wage and annual salary based on the amount given and its pay frequency. SR 300030 SR 100 Monthly Salary Number of Days in a Month Daily working hours.

Pennsylvania is one of 13 states with the federal minimum wage of 725. The latest budget information from January is used to show you exactly what you need to know. Daily wages are calculated using either the gross rate for paid public holidays paid leave salary in lieu and salary deductions or the basic rate for work on rest days or public holidays.

For a weekly pay period multiply 11 x 40 44000 Step 2. You may calculate the daily amount you must pay a seasonal employee with an irregular schedule by taking the following steps. 2175 x 10 overtime hours 21750 in overtime compensation owed for hours 41-50.

Average daily wage total wages earned between January 17 and February 14 2000 divided by 20 days worked 100 or. 1875 x 50 93750 Hourly overtime wages x Total overtime hours Working Hours as per Saudi Labor Law. If you pay every week the employees disposable earnings for the week are 52000 the applicable minimum wage is 11 per hour and there is no other order of higher priority.

Generally salary calculator singapore can classify into two types which is monthly and daily rated. You may receive a monthly or daily salary. These occupational employment and wage estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan areas in Colorado.

Please note this is based on a 40 hour work week with 52 weeks per year and 12 months per year. PAYE tax rates and thresholds 2018 to 2019. Basic rate of pay includes wage adjustments and increments that an employee is entitled to.

Daily maximum wage amount table updated to include amounts for February March and April 2021. Calculate daily wage by dividing the basic salary by 30. Enter your current salary to instantly calculate your daily wage.

A former member of the Low Pay Commission has warned of possible distortions in data that will be used to calculate the new living wage. If you enter your annual wage then the calculator will assume you work 250 days a year 50 weeks of 5 days a week. In this case the daily wage is AED33330.

Average daily wage total wages earned between January 10 and February 7 2000 divided by 20 days worked 100. To find the employees overtime rate multiply their week 4 hourly rate of 1778 by 05 or divide by two. Now multiply the employees overtime pay by how much overtime they worked 5 hours.

The State or local minimum wage would be used to calculate the wages owed to you only if the Federal agency that employs you has broad authority to set your compensation and has decided to use the State or local. 125 x 15 1875 Hourly wages x 15 Total overtime. Like many she has the states minimum wage on her mind.

Calculate your pay for an incomplete month of work. You must calculate the employees overtime pay for the week they worked 45 hours. In this case the amount is AED699930.

8 hours Hourly wages. Most nonexempt employees in California have a legal right to receive overtime wages when they work long hours1 The amount of overtime depends on the length of the employees shift and the number of days. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in.

See My Options Sign Up. This means if you work over 40 hours during the week of typical paid holidays like Christmas or New Years Day you are entitled to time-and-a-half. 12 hourly wage x 15 18.

Two states have minimum wages below that number and five don. Structural changes may result in the termination of employees meaning many businesses will need to calculate the payment in lieu of notice. In other words the overtime hours are paid at your hourly wage plus 50 for the hours worked over 40 hours.

It is therefore essential for businesses to know how to do. May 2021 National Occupational Employment and Wage Estimates United States These estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan areas in every state and the District of Columbia. 889 X 5 4445.

Structural Changes Complying with the Average Daily Wage Calculation Method. Employees overtime pay rate 2175 the regular rate of pay is 1450 12 hourly wage 250hour bonus Step 3. 1778 X 05 889.

Multiply the daily wage by 21 to get the 21-days salary. To calculate the average daily wage the employer can choose between. Overtime wages are a type of increased payment that employees can earn when they work more than a certain number of hours in a workday or workweek.

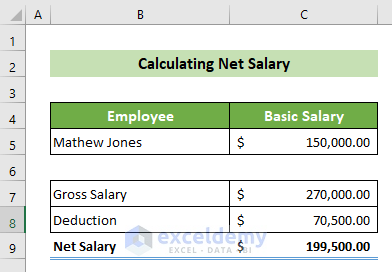

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Wages 14 Steps With Pictures Wikihow

Salary Formula Calculate Salary Calculator Excel Template

Daily Wages Sheet Format In Excel With Quick Steps Exceldemy

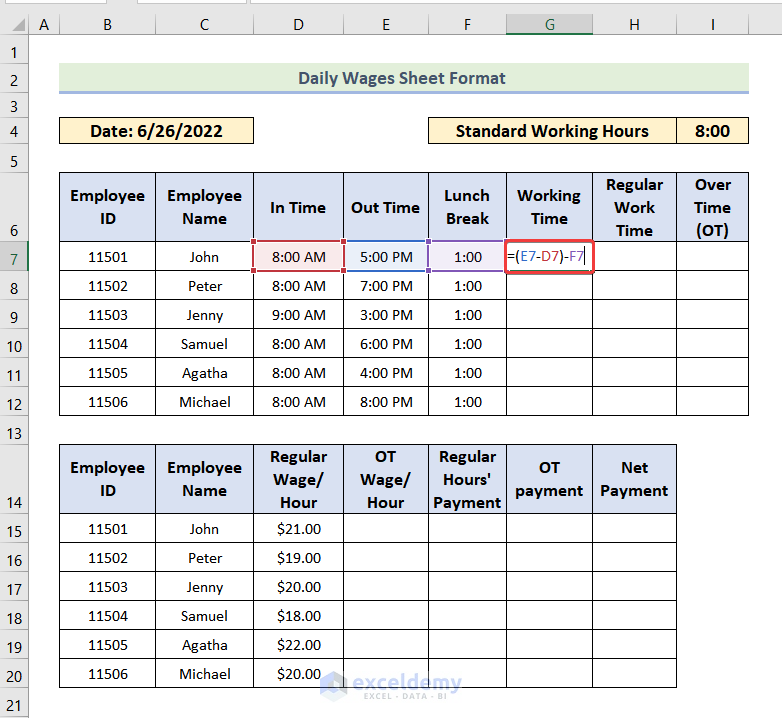

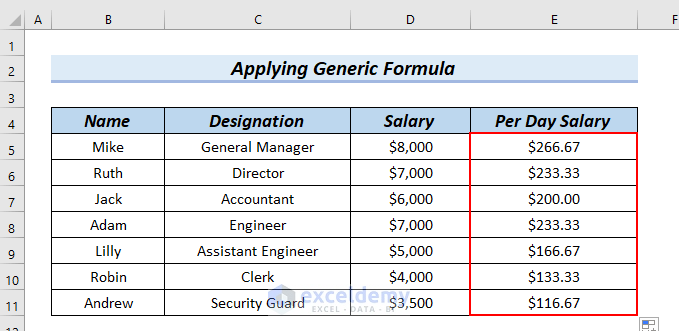

Per Day Salary Calculation Formula In Excel 2 Suitable Examples

Hourly To Salary What Is My Annual Income

Per Day Salary Calculation Formula In Excel 2 Suitable Examples

4 Ways To Calculate Annual Salary Wikihow

Salary Formula Calculate Salary Calculator Excel Template

Annual Salary To Daily Pay Conversion Calculator

Salary Formula Calculate Salary Calculator Excel Template

Your Step By Step Correct Guide To Calculating Overtime Pay

3 Ways To Calculate Your Hourly Rate Wikihow

Calculate Overtime Amount Using Excel Formula

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Make Salary Sheet In Excel With Formula With Detailed Steps

How To Calculate Wages 14 Steps With Pictures Wikihow